This site uses cookies and other tracking technologies to assist with navigation and your ability to provide feedback, analyse your use of our products and services, assist with our promotional and marketing efforts, and provide content from third parties. Read our Cookie Policy here

Allowances NZ

DUTY FREE ALLOWANCE INFORMATION

New Zealand - Allowances per adult:

No more than three (3) bottles of spirits (maximum volume of 1.125L each)

4.5 litres of wine, port, sherry, champagne (6 bottles) or beer (12 cans)

Up to 50 cigarettes or 50g of tobacco products

Other goods purchased at overseas duty free stores, for example beauty products, cannot exceed NZD$700

Australia - Allowances per adult:

2.25 L of alcohol (total)

25 cigarettes or 25g of tobacco products, plus one open packet

AUD$900 worth of general personal goods or AUD$450 worth of general personal goods if an individual is under 18 years of age

Families can combine their Australian personal goods allowance. This includes fragrance, beauty, travel, electronics and personal use products. For example, two adults may pool their personal goods allowance to purchase goods worth AUD $1800. Alcohol allowances cannot be shared between travellers.

Any goods over the above quantities will be subject to a Customs Duty and Good and Services Tax (GST). This includes individual bottles of liquid of greater volume than 1.125L (NZ) and 2.25L (AU).

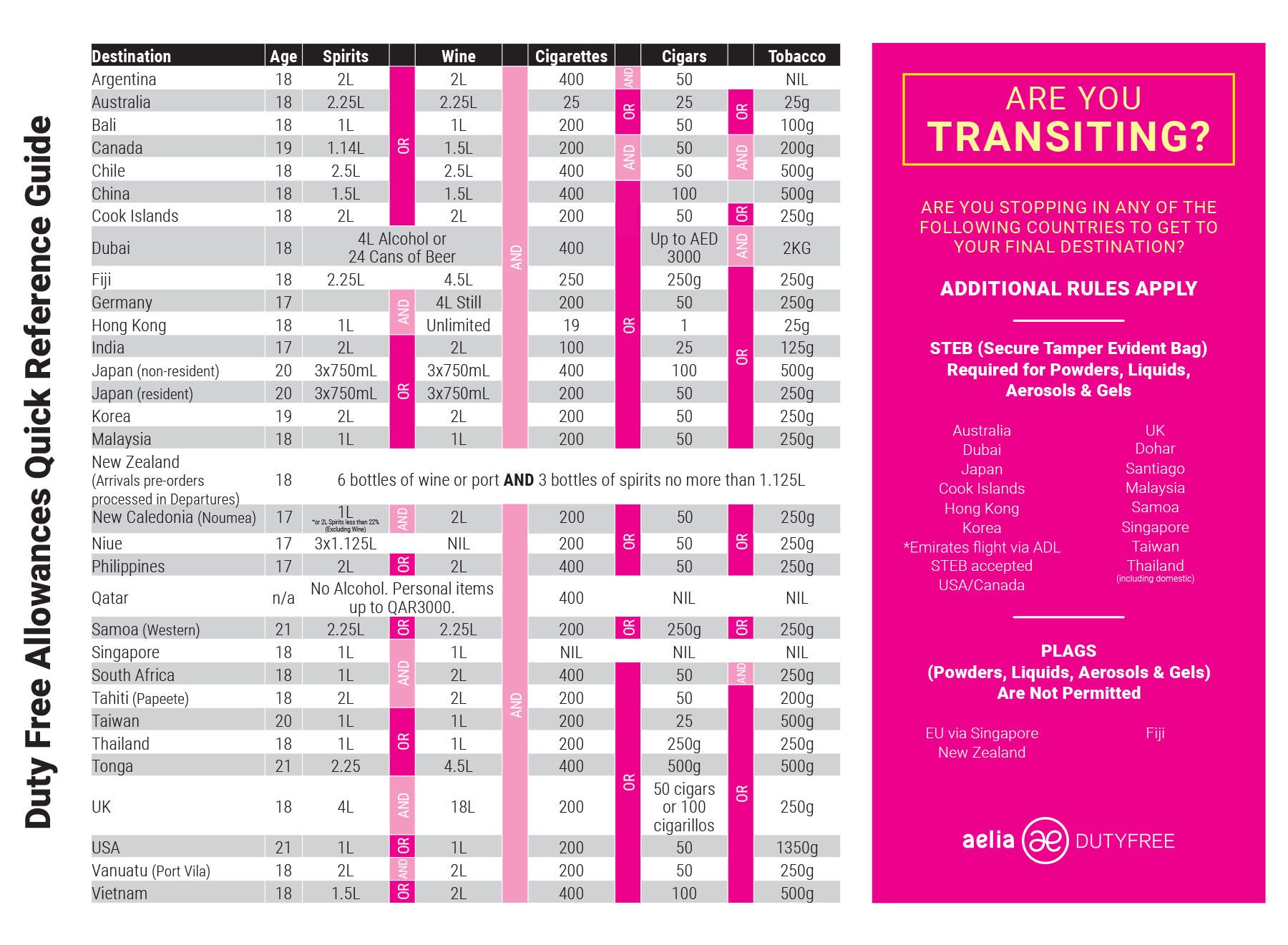

Check the travel allowances for each of your travel destinations

Please note that all duty free allowances for Australia and New Zealand are for personal consumption only, and it is every person’s responsibility to check custom allowances for each destination. If you are unsure about your duty free allowances, call Aelia on 0800 TAXFREE (0800 829 3733) from within NZ or +64-09-927 5460 if calling from overseas. You can also check our Quick Reference Guide below.

Make sure you are clear on the rules when transiting through other countries before reaching your final destination.

Important update for passengers transiting through Singapore from New Zealand - November 2022

From Monday 14th November passengers flying from New Zealand through Singapore and onto European destinations will not be allowed to carry duty free liquids, aerosols and gels ( LAGS ) purchased from New Zealand. This is part of the requirement to meet European Union One Stop Security Arrangements.

If you have pre-ordered duty free and will be travelling after 14th November, please contact our Customer Service at service@aeliadutydfree.co.nz to arrange for alternate pick up.